Cheap solar alone would not prevent a renewable energy gap

On 06.10.2019 by Alejandro Nunez-JimenezBy Alejandro Nuñez-Jimenez

The energy-efficiency gap describes how firms and individuals underinvest in profitable energy-saving technologies.

Will there be a similar gap for investments in renewables?

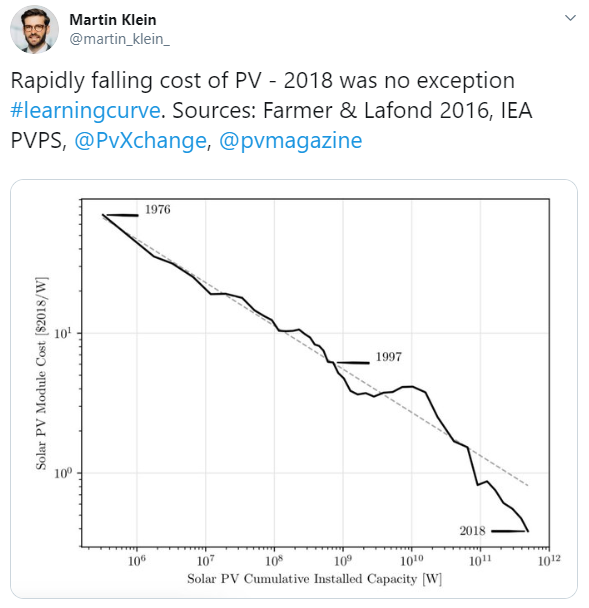

Solar photovoltaic (PV) modules have become very cheap. The price of one Watt of solar power costs today 1,000 times less than 50 years ago.

In fact, solar PV systems are now so cheap that some electricity consumers could recover the cost of installing one on their rooftops in a matter of a few years just from the savings of not buying as much electricity from the grid. Since well-built solar PV systems last 30 years or more, adopters would enjoy “free” (i.e. already paid) emissions-free electricity for decades.

According to an employee of a large Swiss electric utility working in the solar energy business who recently co-supervised one of the master students in our research group, this is precisely the case for a growing number of medium-sized companies with large rooftops across Switzerland. Nobody would blame you for thinking that those firms, at least after they learned about the opportunity, would jump on it and become proud solar PV adopters.

Sadly, that’s not what our colleague from the Swiss utility experienced when she approached them with a solar project offer. The offers detailed the system’s cost, expected savings and an array of different metrics of the project’s profitability (e.g., net present value, payback period) showing the attractive case for adoption. The firms, however, politely declined, in what may be seen as a troubling replication of the “energy-efficiency gap” – when firms or individuals underinvest in profitable (energy efficiency) technologies.

Why did the Swiss, medium-sized companies choose to keep losing money?

Explaining the renewable energy gap

Like any researcher, I turned to the literature to find an answer to this question. Luckily, there is an extensive economics literature on the energy-efficiency gap, which can help us shed some light on the firms’ decisions.

Economists Kenneth Gillingham and Karen Palmer reviewed recent insights from economic theory and empirical evidence about the energy-efficiency gap in this (open access) 2014 paper. They classify the explanations of the gap into market failures or behavioral anomalies.

Market failures are situations in which the market leads a firm or a consumer to make a wrong decision. There are many examples of market failures, for example, those related to the externalities (e.g., costs not reflected in the market price) of fossil fuels.

Among the market failures listed by Gillingham and Palmer, none offers a very convincing answer to our question. Let’s see why.

First, imperfect information: This market failure takes place when decision-makers do not have full knowledge about e.g., the costs and revenues of installing a solar system. Swiss firms, in general, may not be aware of how much money they could save by installing a solar PV system on their rooftop. However, the information provided in the offer by the Swiss utility greatly weakens this argument in our case.

Second, credit constraints: Renewable energy technologies are characterized by high upfront investments and very low operational costs. This is unlikely to be the problem in our context because Switzerland has one of the lowest costs for solar projects (as Florian Egli and colleagues at ETH Zurich have recently shown in Nature Communications). If that was not enough, the Swiss government ensures this is not a barrier handing out a 30% investment subsidy.

Other market failures do not seem relevant for our question, although they may deserve more attention in a longer article.

No excuse for not running your numbers. Household names such as IKEA already offer free quotes for solar projects online.

It’s about the behaviour, stupid!

We turn now towards the behavioral anomalies in our quest for an hypothesis to why the Swiss firms declined a profitable investment in rooftop solar.

At this point, one comment from our Swiss utility source becomes relevant. She explained the firms’ managers declined to invest in solar PV because the savings would amount to too little money.

Two behavioural anomalies emerge as candidates to explain this statement.

First, reference-dependent preferences: When making decisions under uncertainty, for example, those that include future electricity prices, consumers may value different alternatives in relation to a particular reference point. If that point is the current state of affairs, it is called status quo bias.

One firm manager argued that the annual savings from a solar PV system would roughly amount to the salary of one cleaning worker (i.e. not so much money). This suggests the electricity bill is likely a small fraction of the firm’s operational costs. The “pain” of getting the solar system installed, even if the Swiss utility takes care of almost everything, looms larger for the manager than the potential savings from it.

In addition, suboptimal decision heuristics and limited attention anomalies may also be involved. In simple words, the firm managers might use rules of thumb to decide whether or not to adopt solar PV instead of running their own numbers. In addition, firm managers may systematically undervalue future savings in the electricity bill against the system’s price tag. Recent evidence about suboptimal decision heuristics among Swiss households gathered by my colleague Nina Boogen and her group may suggest it could apply for Swiss firm managers.

There could be additional behavioral explanations for why firms do not operate at their best (i.e. not at their efficiency frontiers) but we cannot explore them in this short blog post.

Cheap solar alone would not close the gap

After reviewing some of the literature, here is my hypothesis: The managers of the Swiss firms rejected the offer to install a profitable solar PV system on their rooftops because they are not algorithms continuously optimizing the operations of their companies. Managers are human decision-makers, and, as such, they can also exhibit behavioural anomalies. The key takeaway is that having cheap solar PV available does not necessarily mean it will get installed because firms do not always make optimal decisions.

It is uncertain whether this is a generalized problem or just an anecdote. If a renewable energy gap opens up, it could put at risk the realization of the vast potential for rooftop solar in Switzerland, up to 50 GW, in Europe, the U.S. and beyond.

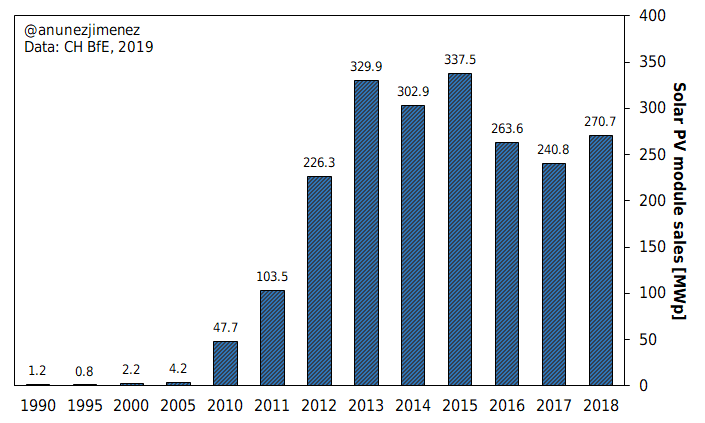

Sales of solar PV modules in Switzerland grew strongly until 2013 and have stalled since. Source: Swiss Federal Office of Energy, 2019.

Cheaper solar alone would not close a renewable energy gap. Neither would the Swiss government investment subsidies already in place. While economic instruments, such as carbon prices or a feed-in tariff, would certainly help, they could have a limited effect. Switzerland already prices carbon and has one of the lowest carbon intensive power systems in the world. In addition, the country is phasing out feed-in tariffs, and they are unlikely to make a comeback.

Therefore, non-economic instruments such as quotas (requiring firms to self-produce a fraction of their electricity demand) or mandates (directly requiring rooftop solar under certain conditions, as some Swiss cantons are starting to do under MuKEn regulation) could prove more effective. Softer approaches, from targeted information campaigns and behavioral nudges, could prove fruitful too.

We need more evidence to assess if a renewable energy gap is emerging. In the meantime, let’s not forget the insights from the energy-efficiency paradox. Cheap energy-efficient cars or fridges were not massively and rapidly adopted, and neither will cheap renewable energies. Ambitious policies will be required to overcome market and behavioral failures

Acknowledges to Nina Boogen who reviewed and helped improve a previous version of this blog post, to Linus Walker for his constructive comments, and Evan Petkov for formatting.

Keep up with the Energy Blog @ ETH Zurich on Twitter @eth_energy_blog.

Suggested citation: Nuñez-Jimenez, Alejandro. “Cheap solar alone would not prevent a renewable energy gap”, Energy Blog, ETH Zurich, October 8, 2019, https://blogs.ethz.ch/energy/cheap-solar/

If you are part of ETH Zurich, we invite you to contribute with your findings and your opinions to make this space a dynamic and relevant outlet for energy insights and debates. Find out how you can contribute and contact the editorial team here to pitch an article idea!

Great blog, thanks! To challenge you’re explanation: I’m not sure if it’s really a behavioral hurdle to adoption. The manager may act perfectly rational because when s/he says “the savings amount to too little money” s/he means (presumably) that the transaction costs involved are higher than the potential savings. If so, it boils down to the old pricing problem. Not sure if any of your suggestions (e.g., quotas, mandates, information campaigns) would really help solve the problem.

Very interesting and relevant post.

I wonder whether, in Switzerland, @BFEenergeia knows about it and what they are doing to address it.

From an innovation studies perspective, I would argue that it is an issue of ‘institutionalization’ or (business) ‘practice’. Innovations do not just need to become competitive and well known. They also need to become ‘normal’, i.e. part of the business as usual. Same as it is common practice, e.g. to hire consultants if you want to re-organize your business, it has to become ‘normal’ to install PV as part of your firm’s (or household’s) energy supply. However, such changes in informal institutional structures take time and require ‘system building’ support from actors like Swisssolar @NordmannRoger.

@Jochen:

Belated thanks for your comment!

To your question: I do not know whether the Swiss Federal Office of Energy is aware of this potential issue or not, or if there are already measures in place to address it.

I agree with your comment about technologies becoming mainstream. Perhaps, there is a small gap between the economic terms and innovation studies. The normalization of technologies could maybe be fitted into behavioural economics terms since one of the effects of institutionalization would be to provide more readily available references in the memory of the decision-maker. This could reduce uncertainty and deliberation costs about the decision, reducing the impact of of status quo bias that I discuss in the post. But this is just a speculation. I have no support for it!

@ Johannes: You are right, the argument “the savings amount to too little money” might be completly valid and the manager acted rational indeed. However, this depends on whether he/she really calculated the hassle costs and ran his/her own numbers or not. If not, then the argument “the savings amount to too little money” might just be a cheap/easy excuse for a “No”. And we would be back with a behavioural barrier….

3 points:

1) The installer cost in CH are among the highest in the world, due to high labor cost but an extreme market fragmentation and a lack of competition among installers.

2) The fragmentation of the electricity market (hundreds of utilities in a country of 8 mio!) also increases transaction costs (especially for firms active in many locations), as each utility has its own rules for connection, compensation of fed in electricity etc.

3) The cost of capital of a corporate are substantially higher than those we looked at in Egli et al, where we focused on large scale projects, that are financed off balance sheet. Once you assume a higher hurdle rate (for equity) the managers might be perfectly rational… (esp if you combine it with with point 1 & 2)

So what is needed?

1) market liberalization and consolidation

2) ambitious solar policy that create competition among installers

3) policies that encourage 3rd-party ownership models, resulting in low cost of capital

just saying…

@Tobias:

Thanks for your comment and for reading the blog!

I very much agree with your points (1) and (2). These are important considerations to take into account the diffusion of solar PV in Switzerland. However, high installation costs and transaction costs from looking for an installer do not apply for the particular case discussed in the post. In the post’s case, the project developer directly contacted the firm (no transaction cost of looking for an installer – unless the firm looked for a second opinion) and offered a profitable project (already inclusive of installation costs).

On point (3), the cost of capital is indeed higher for firms than for large projects. Still, Switzerland compares favourably to nearby markets like Germany or Austria (see [1]). The comparison to Germany is particularly poignant because 40% of installations or 86% of the capacity (something like 40 GW) are systems larger than 10 kW, so likely farmers and small, medium and large firms (see [2]).

I agree that measures (1) and (2) could help the diffusion of rooftop solar in Switzerland.

I am not sure about (3). I may be wrong here, but I think the biggest economic hurdle of PV in Switzerland is low electricity prices rather than high investment costs. The feed-in tariff did really well in encouraging adoption because it ensured people could treat adoption into solar as a secure and profitable way of parking their money. Setting a minimum remuneration price federally, rather than relying on utilities, could help to move into that direction.

[1] https://assets.kpmg/content/dam/kpmg/ch/pdf/cost-of-capital-study-2018.pdf

[2] https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/Photovoltaics-Report.pdf