Security of electricity supply: Can the industry sector fix the Swiss winter deficit?

On 28.11.2022 by Marius Schwarz, Lukas FedererBy Lukas Federer and Dr. Marius Schwarz

Lukas is a Project Manager for economiesuisse, the Federation of Swiss Businesses. As a Regulatory and Public Affairs expert, he advises policy makers on behalf of Swiss businesses, mainly in the areas of infrastructure, energy and environmental policies. He is passionate about creating a regulatory framework that fosters sustainability and innovation. Lukas’ background is a Master’s degree in Economics, a Bachelor’s degree in History and most recently a MAS in Applied Technology at ETH Zürich.

Marius is a Senior Researcher and Manager at the Energy Science Center. He is leading the development of Nexus-e, bringing together multiple groups at ETH Zurich to provide a software for energy system scenarios. His key interest lies in the role of technology and policy in transforming energy systems toward meeting climate and energy targets. Previously, he completed his PhD also at ETH Zürich under the supervision of Prof. Volker Hoffmann at the Group for Sustainability and Technology.

Security of electricity supply and electricity costs have become major business concerns for the Swiss industry sector. On the current trajectory towards a clean energy system, situations in winter with reduced availability of electricity followed by soaring prices may occur more regularly. With Switzerland establishing a strategic reserve to overcome electricity shortage situations, we argue in this blog post that demand-side measures – especially load reductions by industry – should be part of such a reserve, even if the contribution may be small. We present our findings from quantitative assessments and insights from expert interviews.

The current energy crisis jeopardizes the Swiss industry

Since the start of the energy crisis in mid-2021, soaring prices for electricity and fossil fuels have threatened energy-intensive industries and accelerated structural changes in the economy. This is exemplified by the plan of BASF, the world’s biggest chemicals company, to downsize permanently in Europe, claiming that the high energy costs would make Europe increasingly uncompetitive. Stahl Gerlafingen recently brought forward similar claims in Switzerland. A rationing of electricity or an actual shortage situation in winter 2022/23 would put an even greater strain on the sector. Generally, Switzerland has a lack of domestic electricity generation in winter and depends on imports during the cold months. For example, over the past 10 years, Switzerland has imported an average of about 4.5 TWh per winter (~15% of inland electricity demand during the same period), with a peak of 9.7 TWh in the winter of 2016/2017. Such need for imports is expected to increase in the mid-term, while at the same time, neighboring countries’ export capacities might decrease due to the phase-out of fossil and nuclear units.

To avoid an electricity shortage situation in the coming winter, the Swiss government established a strategic reserve for electricity generation. Two measures of the strategic reserve are already put in place: First, a hydropower reserve of 400 GWh is to be held by multiple hydro storage operators from the beginning of December 2022 to mid-May 2023, when hydro storage levels rise again due to natural hydro inflows. Second, backup gas units, which can also run on oil and hydrogen, have been purchased with a total installed capacity of 250 MW. Both measures will be activated as soon as demand is not covered anymore by domestic generation and imports. They remain, however, highly controversial as they come with immense costs. The hydro reserve alone is expected to cost 2.2 billion CHF over the next 4 years.

Generally, shortage situations can be addressed by demand and supply side actions. In view of the immense costs of the supply side measures and to further diversify the set of measures, leveraging the demand side in the strategic reserve should not be neglected. One powerful measure would be to include load reductions in the auction for the strategic reserve, which has been discussed but not included in the ordinance for a strategic reserve for this winter. The basic idea is that large customers (or many small but pooled customers) can tender demand reductions with a specific price level. The auction would then identify the least-cost measure for building a reserve. Such auctioned load reductions may become possible under the revised Electricity Supply Act and may thus contribute to the strategic winter reserve in the future. So, can industry demand reductions actually mitigate electricity shortage situations?

If available at low cost and in large quantities, industry demand reductions can alleviate electricity shortage situations

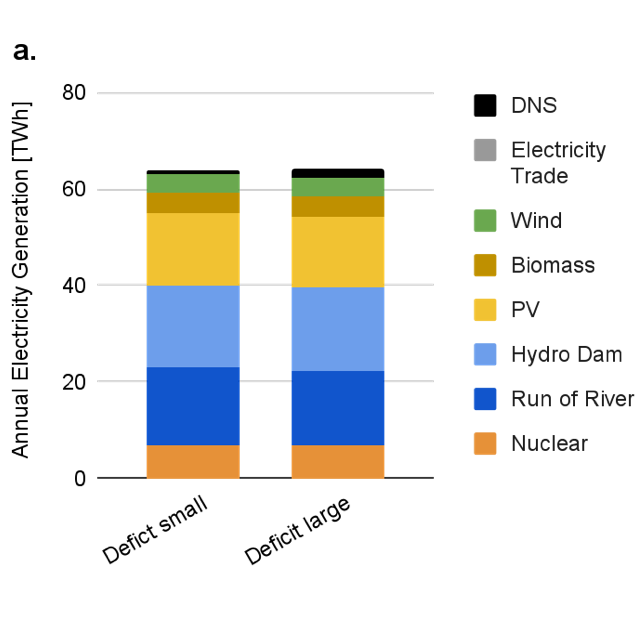

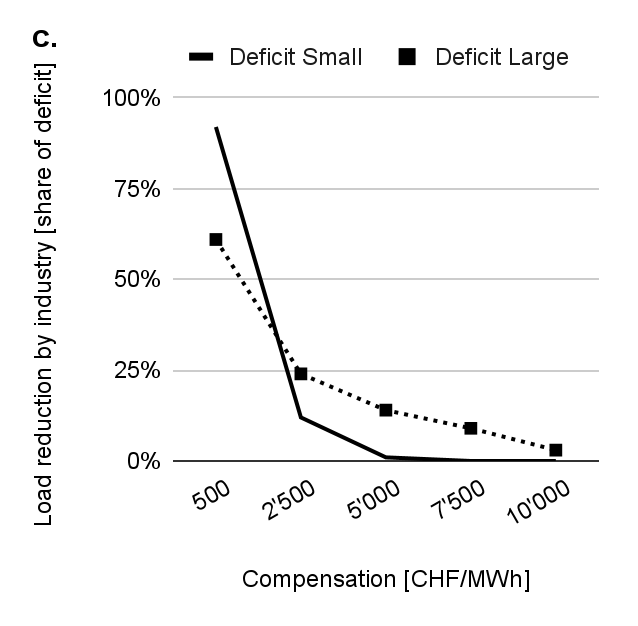

To address this question, we used the energy system modeling platform Nexus-e and a novel dataset containing the electricity demand of about 3’000 Swiss companies and their location, which allows us to understand where and when industry demand reductions might be available. Based on a reference scenario in which supply and imports match demand, we created two deficit scenarios by artificially reducing imports with the consequence that demand is partially not served (DNS scenario). In other words, we assumed in our model that the typically high Swiss electricity imports were partially not served, thus leading to national supply deficits. Figure 1a depicts the annual electricity generation for two different deficit scenarios, one with a deficit of 0.6 TWh and one with a deficit of 1.7 TWh. Having two deficit scenarios allows us to assess the effect of the deficit size on the chosen measure to address the deficit (see next paragraph). Figure 1b shows the hourly electricity generation during a typical winter day for the scenario Deficit Large.

Subsequently, we allow the model to find the cost-optimal solution for the electricity system to address the deficit with two measures: either (i) auctioning industry load reductions or (ii) adding gas units to the electricity mix. Auctioning load reduction has costs for the system as firms would need to be compensated for offering and actually reducing their load. From a system perspective, such compensation entails costs and is only utilized if no other cheaper measure is available. Gas units have investment and operational (fuel, CO2 certificates) costs.

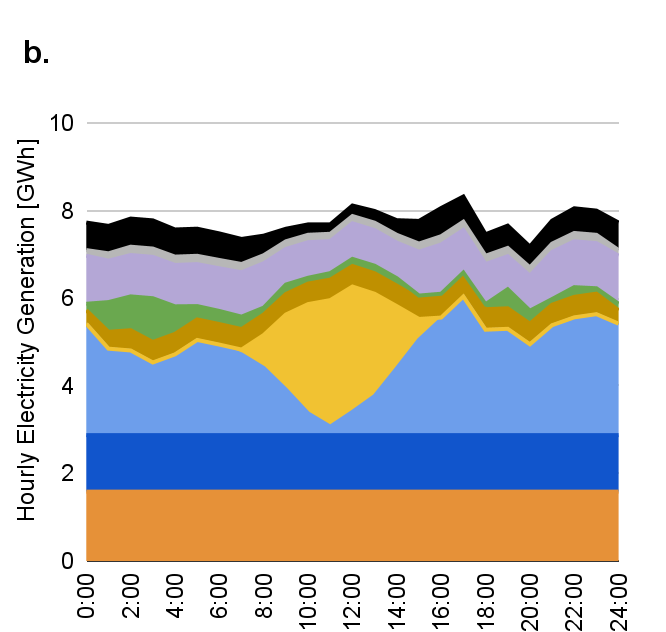

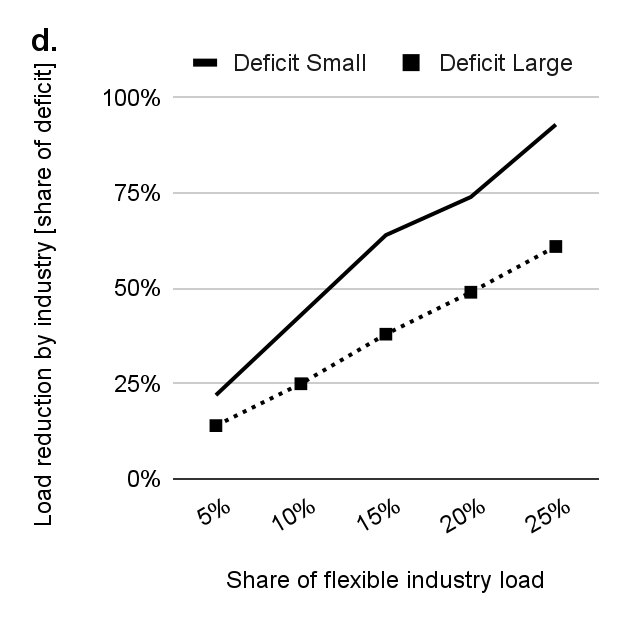

Figure 1c shows the reduced load under varying levels of costs for industry load reduction and a fixed share of industry load that can be reduced by 25 percent (~ 4 TWh). As expected, the results show that load reduction becomes competitive when its cost is in the range of the existing reserve based on hydropower and gas units (500-2500 CHF/MWh). When available at low costs to the system (500 CHF/MWh) and in large quantities (25 percent of total industry load), industry flexibility covers almost 100 percent of the deficit in the model environment. We then fixed the cost for load reduction to 500 CHF/MWh and varied the share of load that firms can actually reduce. Figure 1d shows these results. It becomes evident that as soon we decrease the share of flexible industry load to a more realistic level (5-10 percent), the utilization of load reduction decreases – despite low costs – and only covers 25-40 percent of the deficits.

In summary, the results appear intuitive: The more expensive the companies’ flexibility becomes for the system, the less the model will leverage it. Similarly, the higher the flexible share of industry demand, the higher the potential for demand reduction.

Figure 1: Overview Nexus-e results a. Demand not served (DNS) in the scenario Deficit small amounts to 0.6 TWh, in Deficit large to 1.7 TWh. b. Hourly electricity generation for an exemplary day in winter in Deficit large scenario c. Load reductions for varying costs to the system at 25% flexible load. d. Load reductions for different levels of flexible load at costs of 500 CHF / MWh to the system.

The actual share of flexible industry loads might be very small

Results from complementary expert interviews and other sources, however, indicate that the actual share of industry load that is “flexible” might be considerably smaller than assumed in our scenarios. Many manufacturing processes have to run at the max capacity (or not at all) to ensure product quality and avoid damage to production facilities. Slowing down processes or stopping production for a specific duration is operationally challenging. Moreover, the opportunity costs for shutting down production are typically very high – and in most cases, higher than a potential compensation (designated as costs to the system in our model). Lost sales and revenue, as well as impeded customer relations, often outbalance energy bill savings. Generally, customer and market requirements, global value chains, or technical characteristics of production processes determine the use of energy – and rarely the other way around.

Domestic generation is still the most important and least expensive measure

In summary, industry flexibility is, unfortunately, no panacea for a structural electricity deficit in winter. While auctioned demand reductions should be leveraged to diversify the set of measures when addressing shortage situations in winter, their actual potential is unclear. Reducing load comes with considerable opportunity costs for industry firms that might hinder them from participating in auctions.

Ultimately, it is a delicate matter, as large-scale demand reductions threaten energy-intensive industries and entail the risk of permanent de-industrialization. It is therefore not only a matter of energy policy but more broadly of economic policy. In any case, adding new generation capacities remains the most important and least expensive measure to tackle shortage situations and systemic import dependency in winter. The Swiss parliament has taken steps in the right direction, for example, by allowing large-scale PV systems in the alps, which have generated around half of their annual production in the winter months. With the annual budget of the strategic reserve, roughly 250 MW of alpine PV could be installed – each year! After 3 years, these PV units would provide more electricity in winter than the hydro reserve; after 5 years, they would address the shortage in our Deficit small scenario.

Acknowledgments

We would especially like to thank Jared Garrison, Arijit Upadhyay, and the entire Nexus-e team for their support in the development of the scenarios.

Quelle: Adobe Stock

Keep up with the Energy Blog @ ETH Zurich on Twitter @eth_energy_blog.

Suggested citation: Federer, Lukas and Schwarz, Marius. “Security of electricity supply: Can the industry sector fix the Swiss winter deficit?”, Energy Blog @ ETH Zurich, ETH Zurich, November 28, 2022, https://blogs.ethz.ch/energy/swiss-winter-deficit/

If you are part of ETH Zurich, we invite you to contribute with your findings and your opinions to make this space a dynamic and relevant outlet for energy insights and debates. Find out how you can contribute and contact the editorial team here to pitch an article idea!

Leave a Reply